WI Amortization Debt Filing Form - Milwaukee 2016-2024 free printable template

Get, Create, Make and Sign

Editing amortization court your printable online

WI Amortization Debt Filing Form - Milwaukee Form Versions

How to fill out amortization court your printable

How to fill out amortization debt:

Who needs amortization debt:

Video instructions and help with filling out and completing amortization court your printable

Instructions and Help about amortization filing print form

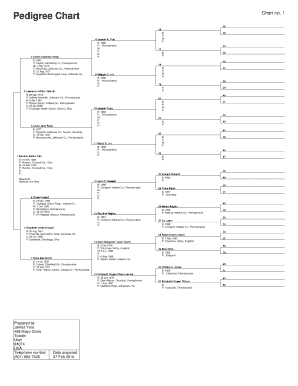

Hi everyone and with this video I want to take you through the time value of money, and I'm not going to get into some heavy mechanics on the formula for a present value of an annuity or anything like that we're going to use some tools in Excel and basically what I want to do with this video is explained the concept of an amortization schedule in other words how a debt is amortized over time as you make payments so let's get started and set up a timeline, and we're in this timeline we most all of us can relate to the buying of a car right, so you go out, and you purchase a car and the present value what it's worth today is basically in this scenario it's the purchase price it's your net purchase price minus any down payment you made and then obviously they're going to say well how long do you want to as a time period to pay it off, and so we're going to make an assumption in this illustration that we're going to use 60 periods 60 payments of an amount seven hundred and twenty-seven dollars and sixty-seven dollars each month and sixty-seven cents excuse me and then the total of payments that you would make would be just sixty times this monthly payment and that's how I get the forty-three thousand 660 well what happens at the end of the five years or sixty months is you'll, you'll end up with a title and so then they'll send that to you in the mail, and you then own the car now during this time line all during these 60 months you're making the payments you own part of the car if you will that you don't really have the title and if you did trade it in, or you sold it what's the first thing you have to do well you have to pay off the amortized balance of that loan, so now you may have some questions you may say okay you know what is that unadvertised balance, but before we get to that let's think about or look at everything all the variables that come into play here first I didn't tell you what interest rate you are being charged I just set it up and said you're gonna you're going to have 60 payments and this is going to be the amount per month and so you really don't know if you're getting a good interest rate or not all we do know is there's some interest rate being charged because the present value of 40 thousand and then if I look at my amount if I have a grenade all of my payments together I'm now I now would have paid forty-three thousand six hundred and sixty dollars so what is the difference well that thirty-six hundred and sixty dollars and twenty cents is interest obviously now what if you can only afford six hundred a month well obviously you could get a different car that's that's cheaper but the other thing you may be able to do is stretch out this period of your repayment instead of sixteen months maybe you want to stretch it out to 72 months add a whole year to that, and you'll be paying on instead of five years would be six years, but it would indeed bring down your monthly payment, and obviously you could shop around for a lower...

Fill amortization debt form print : Try Risk Free

People Also Ask about amortization court your printable

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your amortization court your printable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.