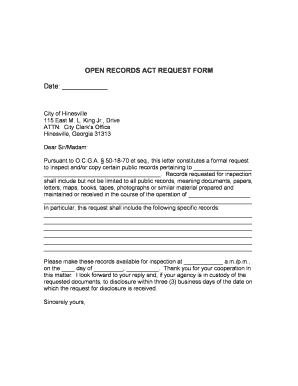

WI Amortization Debt Filing Form - Milwaukee 2016-2026 free printable template

Show details

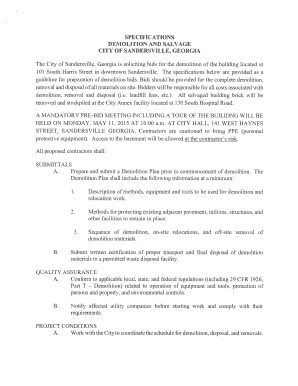

How do I file an amortization of debt action in Milwaukee County In this packet are forms approved for use in Milwaukee County as well as filing directions. What is the difference between amortization of debt and bankruptcy Unlike a Chapter 7 bankruptcy an amortization of debt action does not discharge or wipe out debt without payment. Filing an Amortization of Debt Chapter 128 Case in Milwaukee County This guide is designed to help people who do not have attorneys who are filing an...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI Amortization Debt Filing Form

Edit your WI Amortization Debt Filing Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI Amortization Debt Filing Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI Amortization Debt Filing Form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit WI Amortization Debt Filing Form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI Amortization Debt Filing Form - Milwaukee Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI Amortization Debt Filing Form

How to fill out WI Amortization Debt Filing Form - Milwaukee

01

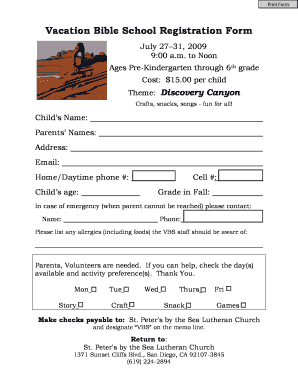

Obtain the WI Amortization Debt Filing Form from the Milwaukee County website or your local government office.

02

Read the instructions carefully before beginning to fill out the form.

03

Enter your personal information including your name, address, and contact details in the designated fields.

04

Provide details about the debt, including the total amount owed, interest rates, and repayment terms.

05

List any assets that may pertain to the debt and specify any exemptions if applicable.

06

Check that all information is accurate and complete, double-check for any errors.

07

Sign and date the form at the bottom to certify that the information provided is true.

08

Submit the completed form to the appropriate Milwaukee County office as instructed.

Who needs WI Amortization Debt Filing Form - Milwaukee?

01

Individuals or businesses in Milwaukee who have incurred debt and are seeking to establish a repayment plan.

02

Those looking to consolidate their debts into an amortization schedule for better financial management.

03

Creditors or financial institutions that require documentation of an amortization plan as part of the debt settlement process.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate amortized debt?

Amortized Loan Formula = [Borrowed Amount * i * (1+i) n] / [(1+i) n – 1) The rate of interest is represented as i. The tenure of the loan is represented as n.

What is debt amortization?

What is amortization of a loan? Loans can include consumer credit, a bank loan and a mortgage. Amortization in this case is the gradual reduction of the debt through the repayments we agree with the lender. Broadly speaking, loan amortization only considers the principal and doesn't include interest.

What is a good example of an amortized loan?

Examples of typically amortized loans include mortgages, car loans, and student loans.

What are the 3 components of amortization?

Amortization tables typically include a line for scheduled payments, interest expenses, and principal repayment.

What types of items are amortized?

Amortization is most commonly used for the gradual write-down of the cost of those intangible assets that have a specific useful life. Examples of intangible assets are patents, copyrights, taxi licenses, and trademarks. The concept also applies to such items as the discount on notes receivable and deferred charges.

What is an example of amortization?

What Is an Example of Amortization? A company may amortize the cost of a patent over its useful life. Say the company owns the exclusive rights over a patent for 10 years, and the patent is not to renew at the end of the period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the WI Amortization Debt Filing Form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your WI Amortization Debt Filing Form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit WI Amortization Debt Filing Form on an Android device?

With the pdfFiller Android app, you can edit, sign, and share WI Amortization Debt Filing Form on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I complete WI Amortization Debt Filing Form on an Android device?

Complete WI Amortization Debt Filing Form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is WI Amortization Debt Filing Form - Milwaukee?

The WI Amortization Debt Filing Form - Milwaukee is a document used by residents to report amortizable debt for tax purposes in Milwaukee, Wisconsin.

Who is required to file WI Amortization Debt Filing Form - Milwaukee?

Individuals or entities that hold amortizable debts and are required to report these debts to the Milwaukee tax authority must file this form.

How to fill out WI Amortization Debt Filing Form - Milwaukee?

To fill out the WI Amortization Debt Filing Form, you must provide personal information, details about the debt, the amortization schedule, and any applicable interest payments.

What is the purpose of WI Amortization Debt Filing Form - Milwaukee?

The purpose of the WI Amortization Debt Filing Form - Milwaukee is to ensure accurate reporting of amortizable debt for taxation and to assist in calculating the relevant tax deductions.

What information must be reported on WI Amortization Debt Filing Form - Milwaukee?

The form requires reporting of the debtor's name and address, type and amount of debt, interest rate, and amortization details, including payment schedule and maturity date.

Fill out your WI Amortization Debt Filing Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI Amortization Debt Filing Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.